Category Archives: Alternative Finance

Einstein, Financial Black Holes & Different Realities

What did Einstein say was the most powerful force in the universe?

In the first part of this enjoyable (and at times funny) video, you’ll find out. Part 1– a physicist’s view on global financial and economic news as central bankers play dice with the financial universe. Enjoy the video.

Two Types Of Wealth Creation From A Macro Level

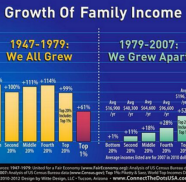

After decades of denial, the mainstream has finally conceded that rising income and wealth inequality is a problem–not just economically, but politically, for as we all know wealth buys political influence/favors, and as we’ll see below, the federal government enables and enforces most of the skims and scams that have made the rich richer and everyone else poorer. Find out about the two types of wealth creation (from a macro level) and which one has skyrocketed and why!

“Panama Papers” Financial Bombshell– Beware of Half-Truths That Disempower Us!

This bombshell story is referred to as the “Panama Papers” – millions of leaked internal documents from the Panamanian law firm Mossack Fonseca, revealed how hundreds of thousands of people with money to hide used anonymous shell corporations for this purpose.

But before we jump to conclusions, remember that we can’t just be sheep and follow the herd mentality of accepting whatever ideas the mass media feeds us.

The mass media wants people to be programmed with the idea that people who use “tax havens,” such as foreign companies or offshore accounts, are evil. But it’s not that tax havens per se are evil, it is the people who gained their wealth thru illegal and immoral ways that is the issue.

So the truth is that tax havens can be evil IF the money being sheltered was acquired thru illegal or immoral ways. But honest-earned money deserves to be sheltered, and legal tax havens help citizens not only keep more of their hard earned money but also help make the world a better place.

Honest citizens deserve to reduce the amount of tax they owe. We need to have the freedom to choose how we manage our money. We, in fact, would ALL do the world much good to take legal steps to reduce taxes we owe. Tax havens, like money, can be used for good or for evil. Let’s not be disempowered to create money or to keep as much as our money as possible thru legal means.

In that way, we would not be supporting governments immoral use of our hard-earned money to fund wars or to bail out banks and destroy the economy.

Rule #1: Make sure you’re in a position of strength

Going in to the 2008 financial crisis, the size of the subprime market (what essentially caused the meltdown) was $1.3 trillion. Today the amount of bonds issued by bankrupt governments yielding NEGATIVE interest rates is over five times that size.

The 2016 financial bubble is MUCH bigger than in 2008.

This means the last financial crisis was just a warm up. And with whatever comes next, whenever that may be, a lot of people will get hurt.

Your best offense is to make sure that you’re not a victim. This is rule #1.

Gold & Golden Opportunities

Why buy real assets such as gold?

First, commodities, such as gold and silver, provide protection against economic instability and over the long-term rise during economic downturns. Also, they provide protection against financial market declines. For example, unlike stock prices that can go to zero, the value of commodities cannot. Commodities are tangible assets, and they offer no credit risk. There are no questionable financial statements to figure out, no convoluted accounting, like in buying stocks.

Why is this a good window of opportunity to buy gold now?

Gold has been rising because the economy and stock market are collapsing. The unprecedented debt that’s been skyrocketing since the last 2008 financial market meltdown is triggering another meltdown. Contrary, to what the main stream media is saying, the U.S. economy is in serious trouble and heading toward another collapse that is likely to be bigger than the one we had in 2008.